cancle student debt

Canceling Student Debt Could Help Close The Wealth Gap Between White And Black Americans

When President Biden announced that he planned to forgive $10,000 in student loan debt for Americans earning less than $125,000 a year and an additional $10,000 for those who used Pell Grants to attend college.

In an article we published earlier this year, we looked at why canceling student debt is one of the best ways to start to close America’s racial wealth gap. Read more about how Biden’s student loan plan could help with this — or come up short.

America’s racial wealth gap is well-documented, even if many continue to underestimate its existence. Black Americans’ net worth is, on average, less than 15 percent of white Americans’, the legacy of centuries of systemic anti-Black racism. Moreover, both political parties have failed time and again to address the inequities facing Black Americans.

But what if I told you that an effective way to start closing this gap was within reach? According to the scholars I talked with who study this issue, canceling student debt is one of the best ways to start to close America’s racial wealth gap, and although it has its risks, it’s something that President Biden can do on his own by executive order.

“Higher education was supposed to be the engine for some to secure financial security and stability,” said Fenaba Addo, a professor of public policy at the University of North Carolina, Chapel Hill, who has researched the links between debt and wealth inequality. But she told me that just hasn’t happened. “The realized gains have not been distributed equally, and student debt has contributed to that,” said Addo.

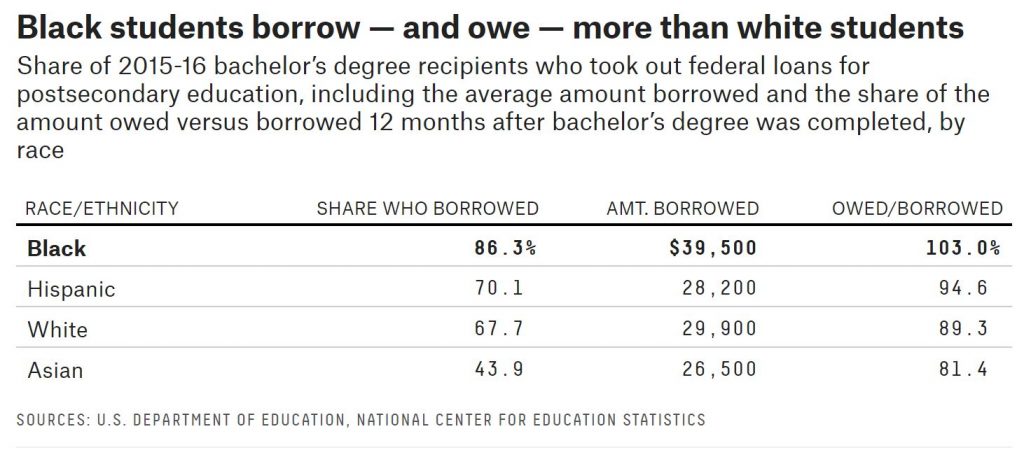

Today, the typical graduating college student owes about $30,000 in student debt, about four times more than they did 50 years ago. But that topline figure masks some real racial disparities. Consider that because Black students tend to come from poorer households than their white counterparts, they are more likely to take out loans — and take out larger loans. Moreover, even white students who end up borrowing money for college have, on average, more preexisting family wealth at their disposal to pay down their debts.

In other words, student debt exacerbates the racial wealth gap, starting from the moment that newly christened graduates toss their caps in the air.

And the further removed from college young Americans become, the more this disparity grows — more than triple, according to a 2016 report from the Brookings Institution — sapping Black Americans’ net worth even more. A 2018 paper from Addo and sociologist Jason Houle found, for example, that if younger Black adults held the same level of debt as their white peers, the racial wealth gap in young adulthood would be reduced by about 10 percent. Addo and Houle also found that student debt’s contribution to the racial wealth gap increased with age, from 13 percent at 25 to 23 percent at 30.

Crucially, too, the racial gap in student debt levels has only grown in recent years. A 2017 paper found that the average student debt for Black households — and number of Black households holding any student debt — increased significantly from 2001 to 2013. The authors found, further, that this growing divide was not because of more Black Americans attending college, but due to disproportionate exploitation by predatory lenders.

Louise Seamster, a professor of sociology, criminology and African American studies at the University of Iowa and a co-author of the paper, said the fact that Black students tend to carry far more student debt contradicts the idea that higher education is a means to mobility. “If the racial wealth gap between Black and white Americans is 10-to-1, at the median for all families, when we just look at the racial wealth gap between Black and white borrowers, it’s actually twice as bad,” Seamster said.

This is the context in which canceling student debt has entered the political discourse. Progressive Democrats have made the case that forgiving student loans would ease the burden on millions of families, while Republicans (and some Democrats) have argued that it would disproportionately benefit the wealthiest Americans.